Payroll calculator georgia

An employee received a pay raise of 115 an hour by the owner but the owner forgot to inform the payroll department. Chances are its the last thing you want to think.

Calculation Free Vector Icons Designed By Icon Pond Free Icons Vector Icon Design Web App Design

Tax year Filing status Taxable income Rate.

. Refer to Tax Foundation for more. Helping companies launch expand and operate in global markets and use other peoples assets local legal entities - as vehicles to hire compensate provide benefits to their international workforce as well as helps companies transfer their. Salary Paycheck and Payroll Calculator.

There is no state-level payroll tax. Free Payroll Services for 3 Months. Fast easy accurate payroll and tax so you save time and money.

If you make 55000 a year living in the region of Florida USA you will be taxed 9076That means that your net pay will be 45925 per year or 3827 per month. Why Gusto Payroll and more Payroll. Use this payroll tax calculator to see how adding new employees will affect your payroll taxes.

State and local income tax rates. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. These tax tables are then amongst other things used to calculate Georgia state tax and associated payroll.

Your average tax rate is 165 and your marginal tax rate is 297This marginal tax rate means that your immediate additional income will be taxed at this rate. 5900year afterwards for up to 3 employees. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions.

The service used as a vehicle for global expansion with a light footprint and risk-averse compliant employment of overseas personnel. The employee will need the difference paid as retro pay for the 40 hours in the prior period back to the date the raise. Important Note on Calculator.

Each filer type has different progressive tax rates. If all you need is a hard copy of your free work hours calculator report just use the Print This button and youre ready to send it off to your accounting department or store it as a permanent record. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries.

There is no state-level payroll tax. As a bonus the course provides preparation for the National Bookkeepers Association NBA Payroll Certification Exam. Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance.

Income Tax Calculator 2022. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia paycheck calculator. Payroll runs the employees last paycheck using the old pay rate to calculate earnings.

At any time you can activate to start your billing cycle and gain access to items like tax filing and approving payrolls beyond the current month. Access Financial is the leading international payroll and contract management solutions provider to recruiters corporations and professional contractors. However if you wish to have a copy of your timesheet employee attendance record it.

Dont want to calculate this by hand. Faroe Islands Fiji Finland France French Guiana French Polynesia French Southern Territories. Download a PDF Report.

Refer to Tax Foundation for more details. Payroll check calculator is updated for payroll year 2022 and new W4. Georgia Sales Tax Holidays in 2013 A sales tax holiday is a special time period in which you are allowed to purchase certain items without having to pay the Georgia sales tax.

South Carolina Paycheck Calculator Calculate your take home pay after federal South Carolina taxes Updated for 2022 tax year on Aug 02 2022. Switch to Georgia hourly calculator. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Upon processing your first payroll you can use Wave Payroll for up to 30 days commitment-free. Calculating paychecks and need some help. Youll learn payroll training payroll management processes and much more.

Subtract any deductions and payroll taxes from the gross pay to get net pay. Automatic deductions and filings direct deposits W-2s and 1099s. The Georgia sales tax is 4 so taking advantage of a Georgia sales tax holiday to buy 50000 worth of goods would save you a total of 2000.

The PaycheckCity salary calculator will do the calculating for you. This number is the gross pay per pay period. Georgia Illinois New York Pennsylvania Texas and Virginia at this time Price subject to change without notice.

Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Software needs. Employers in large and small businesses understand the need for a well-trained and detail-conscious individual to fill this rolethat could be you. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution.

Oregon Paycheck Calculator Calculate your take home pay after federal Oregon taxes Updated for 2022 tax year on Aug 02 2022. Find out how much your salary is after tax in two clicks. EXPORTING THE WORK HOURS CALCULATOR DATA.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and. It can be a little daunting when its time to get out that calculator and run payroll. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State Income Tax Rates and Thresholds in 2022.

It should not be relied upon to calculate exact taxes payroll or other financial data. Georgia has five sales tax holidays throughout the year on a. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees.

Free Corporation Tax Filing With Accounting Package Available At Abacconsulting Taxation Tax Accounting Account Filing Taxes Income Tax Income Tax Return

Reliable Support From A Qualified Accountancy Firm In London Services Business Services Tax Advisers Payroll C Certified Accountant Accounting Payroll

Ready To Use Paycheck Calculator Excel Template Msofficegeek

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Ready To Use Paycheck Calculator Excel Template Msofficegeek

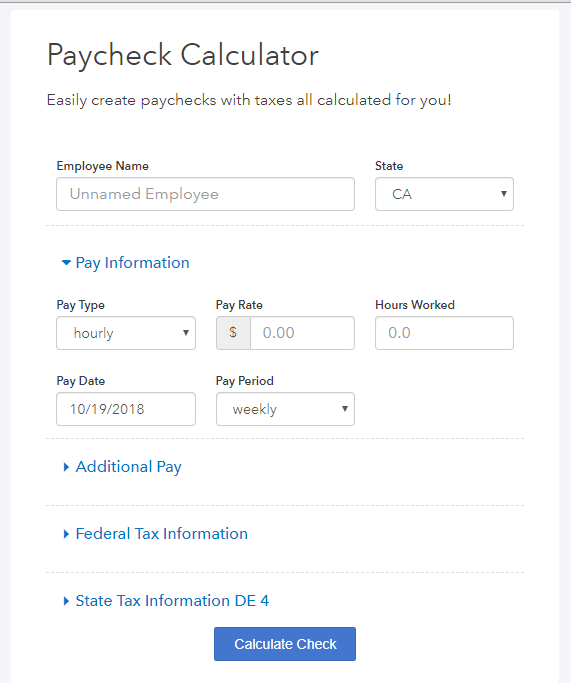

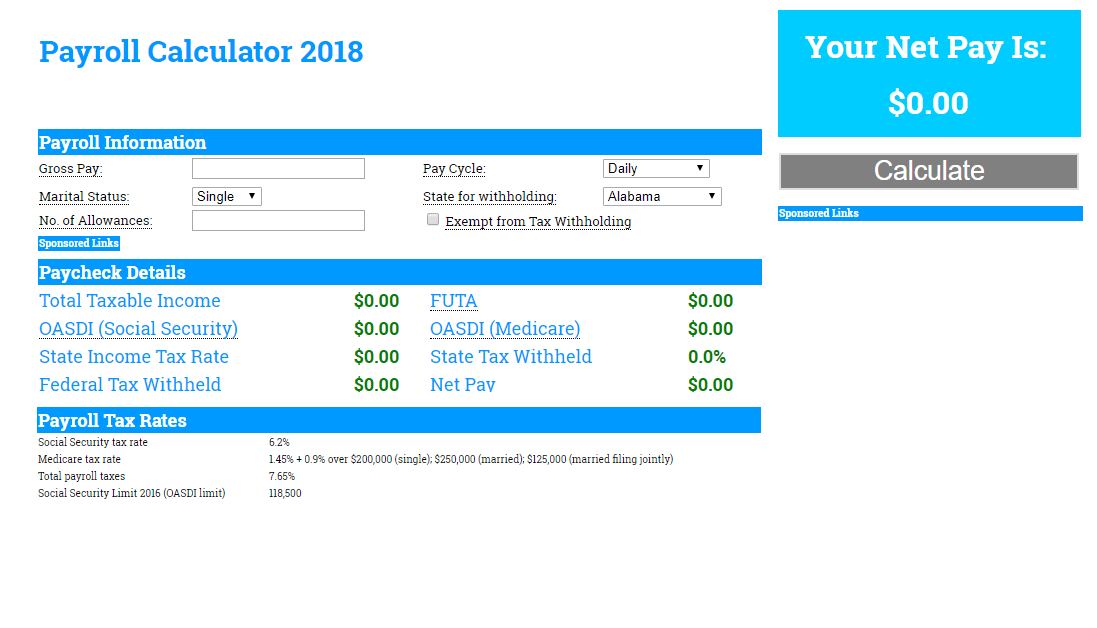

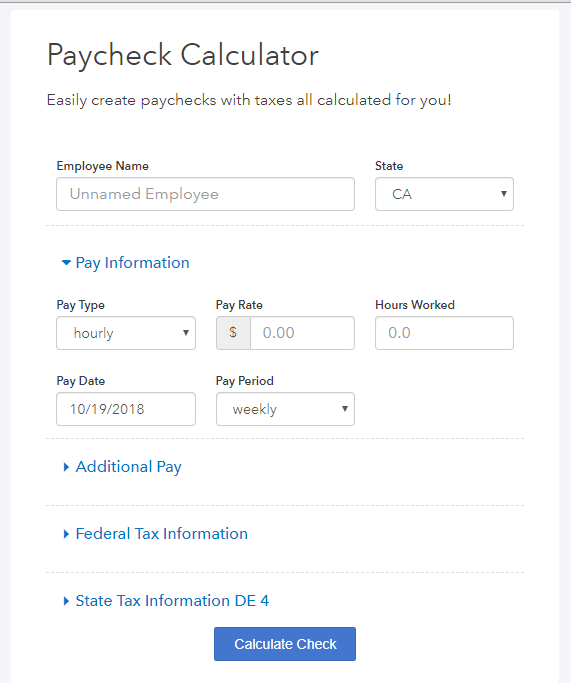

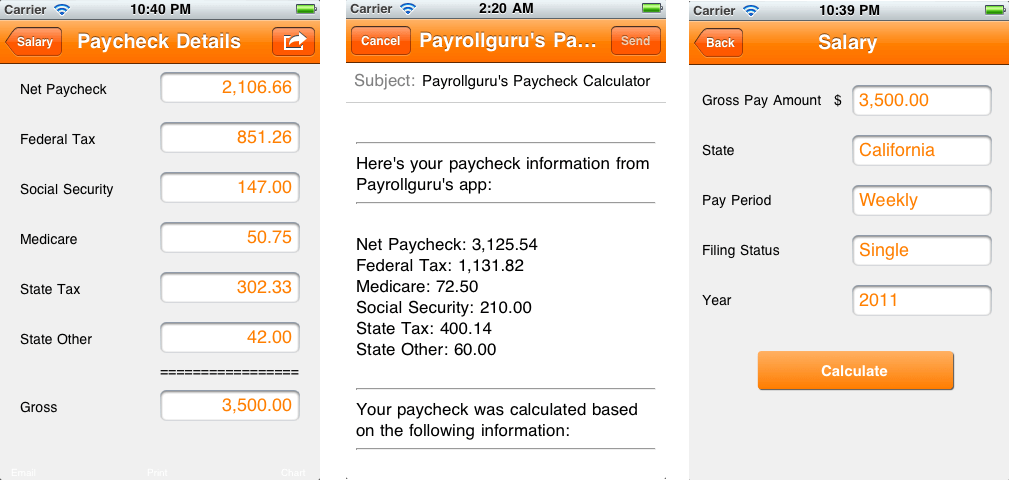

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

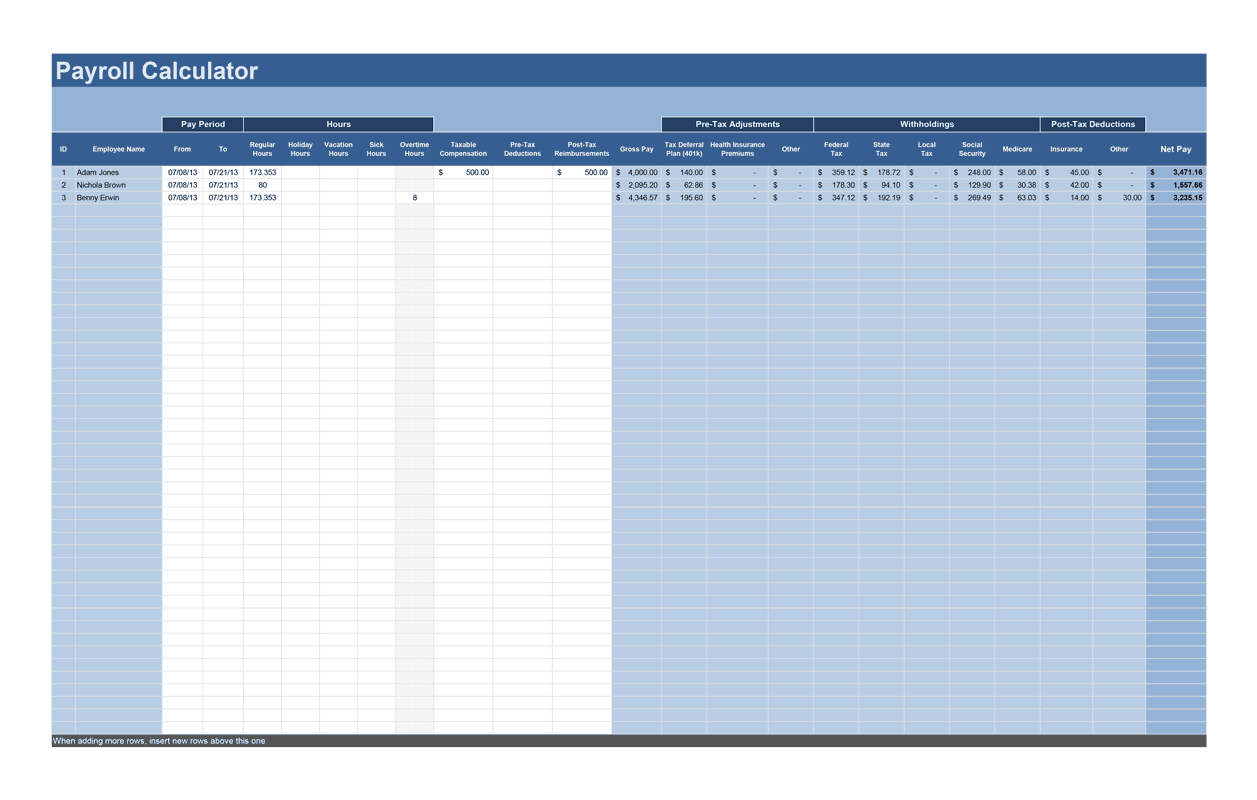

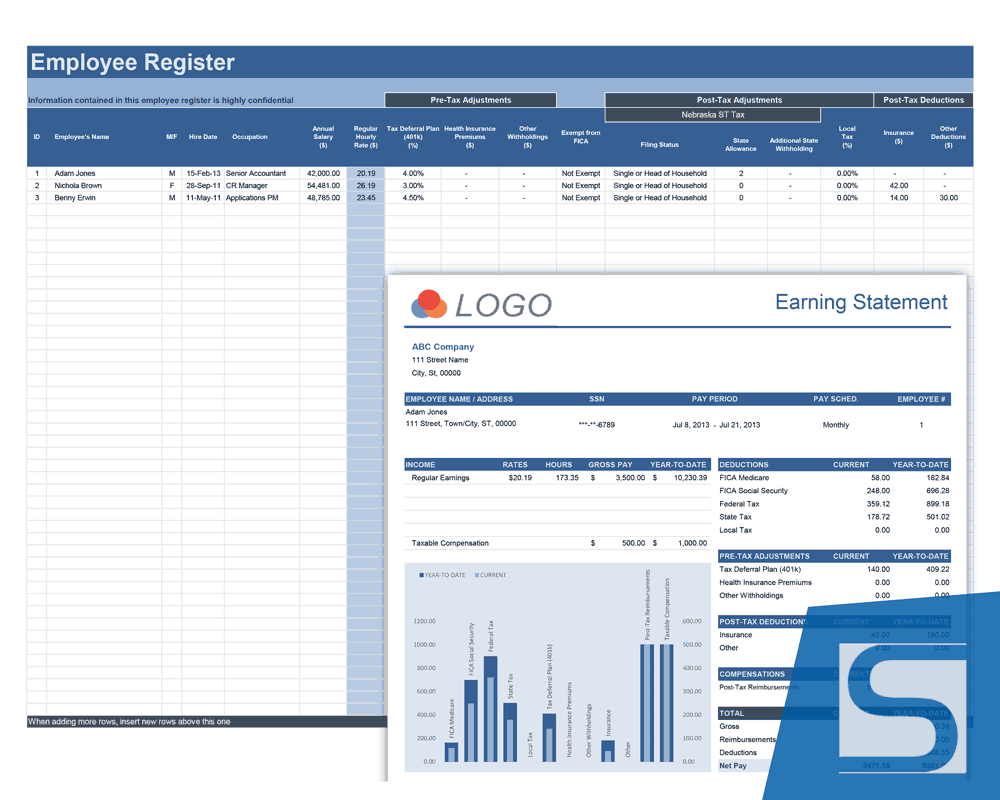

Payroll Calculator Free Employee Payroll Template For Excel

Georgia Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Vacation Itinerary Packing List Template In Excel Packing List Template List Template Vacation Itinerary Template

Paycheck Calculator Take Home Pay Calculator

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Payroll Calculator Free Employee Payroll Template For Excel

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

12 Free Delivery Receipt Templates Ms Word Excel Pdf Formats Receipt Template Invoice Template Word Receipt

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Payroll Calculator Free Employee Payroll Template For Excel